Accounting software is more than just a tool for managing numbers; it holds the key to unlocking crucial insights that drive informed decision-making. By automating repetitive tasks like data entry and reconciliation, accounting software frees up valuable time for small business owners to focus on growth strategies and client relationships. With real-time access to financial data, businesses can make proactive decisions that optimize cash flow and minimize risks, paving the way for sustained success.

Furthermore, accounting software also plays a pivotal role in enhancing accuracy and compliance. Automating processes reduces the margin of error associated with manual calculations and data entry, ensuring that financial reports are not only precise but also compliant with regulatory standards. This not only instills confidence in stakeholders but also contributes to a solid foundation for long-term business sustainability. In an age where precision and speed are paramount, the importance of embracing robust accounting software cannot be overstated.

When it comes to small business accounting, QB accounting software offers a variety of versions tailored to different needs. QuickBooks Online is a popular choice for businesses that require remote access and collaboration with multiple users. Its cloud-based nature makes it flexible and accessible from anywhere, which is ideal for businesses on the go. On the other hand, QuickBooks Desktop is suitable for businesses that prefer traditional software installation and offline use. It provides comprehensive functionality and is often chosen by businesses with complex inventory management needs.

For small service-based businesses, QuickBooks Self-Employed provides a simplified solution focused on tracking income and expenses, making it perfect for freelancers or independent contractors. Additionally, QuickBooks Enterprise is designed for larger small businesses with advanced reporting needs, complex workflows, and high transaction volumes. Understanding the differences between these versions can help small business owners make an informed decision based on their unique requirements and industry-specific demands.

Setting up your company file in QB accounting software is a crucial first step in ensuring accurate financial records for your small business. Begin by opening QB accounting software and selecting Create a New Company to get started. Next, input your company's name, industry, and contact information. Then, customize your chart of accounts to match your business needs. Remember to integrate bank accounts and set up vendors and customers for smooth transaction recording.

After the initial setup, take time to familiarize yourself with the reporting features within QB accounting software. Customize reports such as profit and loss statements or balance sheets to track the financial health of your business effectively. Lastly, regularly back up your company file on an external drive or cloud storage for added security against data loss.

By following these simple steps and utilizing QB accounting software’s comprehensive tools, you can establish a strong foundation for accurate bookkeeping while optimizing efficiency within your small business operations.

As small businesses continue to grow, it's crucial to explore the key features and functionalities of accounting software like QuickBooks, which can streamline financial processes. One notable feature is its invoicing capability, allowing businesses to create professional invoices and automate payment reminders. This not only saves time but also ensures that payments are received promptly, improving cash flow.

Another essential functionality is QuickBooks' expense tracking tool, which enables businesses to monitor their spending in real time and categorize expenses for accurate reporting. This feature provides insights into where money is being allocated and helps identify areas for potential cost savings. Additionally, QuickBooks' ability to integrate with bank accounts and credit cards streamlines reconciliation processes while minimizing errors.

Furthermore, the software's customizable reporting options empower small business owners to track key performance metrics and make data-driven decisions. With the ability to generate balance sheets, profit and loss statements, and cash flow forecasts, QB accounting software provides invaluable insights into a company's financial health. By fully exploring these features and functionalities within QuickBooks software, small businesses can enhance efficiency, gain valuable insights into their finances, and ultimately achieve greater success.

Managing invoicing, and expenses, and tracking payments is a crucial aspect of running a small business effectively. With QB accounting software, you can streamline these tasks to ensure financial stability and growth. Invoicing becomes seamless as you can customize and automate the process, saving time and reducing errors. Moreover, keeping track of expenses is simplified through the ability to categorize transactions, making it easier to monitor cash flow and make informed decisions.

One key advantage of using QB accounting software for tracking payments is the ability to set up recurring payments or reminders, ensuring that you never miss a payment deadline. This proactive approach allows for better cash flow management and improved vendor relations. Additionally, with real-time access to payment information, you can identify any outstanding invoices or late payments promptly, enabling you to take necessary actions to maintain healthy financial operations. Overall, leveraging QB accounting software empowers small businesses to stay organized and focused on driving success without being bogged down by administrative tasks.

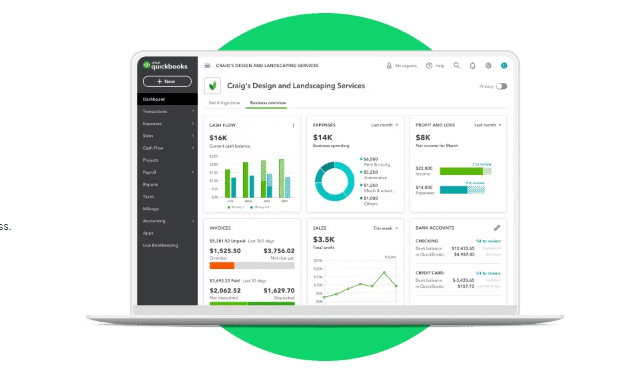

While QB accounting software is a powerful tool for managing financial transactions, its reporting tools provide an additional layer of insight that can greatly benefit small businesses. By harnessing the power of QuickBooks reporting tools, business owners can gain valuable insights into their company's financial health, performance trends, and areas for improvement. With customizable reports and dashboards, users can easily track key metrics such as cash flow, revenue trends, expenses, and profitability.

One of the most impactful features of QuickBooks reporting tools is the ability to generate comparative reports that allow businesses to analyze their performance over time or benchmark against industry averages. This functionality enables business owners to make data-driven decisions based on real-time information rather than relying on guesswork or intuition. Additionally, visual representation of data through graphs and charts makes it easier to identify patterns and correlations that may not be immediately apparent when looking at raw numbers alone.

Furthermore, reliable reports ensure compliance with regulatory requirements while also providing valuable insights for strategic decision-making. This level of transparency allows business owners to have a comprehensive understanding of their financial position and make informed decisions about resource allocation and investments in growth opportunities.

In today's fast-paced business environment, streamlining processes is essential for small businesses to stay competitive and efficient. One powerful way to achieve this is through integrating QB accounting software with other tools and applications. By seamlessly connecting different systems, businesses can automate repetitive tasks, eliminate manual data entry, and gain real-time visibility into their financial performance.

For example, integrating QB accounting software with a customer relationship management (CRM) tool can provide valuable insights into customer interactions and purchasing behaviors. This integration enables businesses to efficiently track sales opportunities, manage customer invoices and payments, and streamline the overall sales process. Additionally, by integrating project management software with QuickBooks, businesses can effectively track project expenses against budgets, create accurate invoices based on time and expenses logged in the project management system, and ensure better financial control over their projects.

Ultimately, integrating QuickBooks software with other tools empowers small businesses to optimize their operations by reducing errors, and improving decision-making through better data accessibility and accuracy. This streamlined approach not only saves time but also enhances productivity while providing a more holistic view of the business's financial health.

QuickBooks software offers a plethora of benefits for small businesses, making it an indispensable tool for financial management. Firstly, its user-friendly interface and intuitive features make accounting tasks streamlined and accessible for even the most financially inexperienced business owner. This can lead to significant time savings and reduced errors when managing expenses, invoicing clients, or reconciling accounts.

Moreover, QB accounting software provides valuable insights into a company's financial health through robust reporting capabilities. Small business owners can easily generate custom reports to analyze their cash flow, monitor sales trends, and track expenses in real time. This data-driven approach empowers entrepreneurs to make informed decisions that drive profitability and growth. Additionally, seamless integration with banking institutions allows for automatic transaction reconciliation, enabling small businesses to maintain accurate financial records without manual data entry.

In today's digital age, QuickBooks' cloud-based platform enables small businesses to access their financial information from anywhere at any time, facilitating remote work and collaboration among team members or accountants. Furthermore, its comprehensive range of third-party applications offers additional functionalities such as inventory management or payroll processing – further enhancing the software's value proposition for small businesses looking to streamline operations effectively.